Blog

- Details

- Hits: 698

Inflation in the UK is refusing to quietly fade into the background. After months of expectations that things were cooling off, the latest data shows inflation is ticking upward again — and that’s keeping the Bank of England (BoE) on its toes as it weighs up its next move on interest rates.

So where does this leave homeowners, buyers, and investors — particularly in Scotland, where the market often dances to its own beat?

Inflation: Still Sticky, Still a Concern

As of June 2025, the Consumer Prices Index (CPI) sits at 3.6%, up slightly from 3.4% in May. While it’s a long way from the 11% peak we saw back in 2022, it’s still well above the Bank of England’s 2% target. What’s more, the underlying pressures don’t look like they’re going anywhere fast.

Core inflation — which strips out volatile items like food and energy — is currently 3.7%. Services inflation is even stickier, at 4.7%. And food prices are still creeping up, with the sixth consecutive monthly rise recorded in June. All of this is keeping inflation expectations stubbornly high, even as broader economic activity shows signs of slowing.

Business confidence surveys point to a weakening services sector, rising input costs, and cautious hiring trends. The job market is softening, with unemployment now at 4.7%. In short: this is not an economy roaring ahead — but it’s also not one that’s easing inflation as quickly as the BoE would like.

What Will the Bank of England Do Next?

All eyes are on the BoE’s next interest rate decision, due on 8 August 2025. The current Bank Rate is 4.25%, down from a peak of 5.25% last year. After a few months of holding steady, economists are increasingly predicting that a rate cut is coming — and soon.

Most analysts now expect a 0.25% cut in August, which would take the Bank Rate to 4.00%. A second cut is likely before the end of the year, possibly in November, which could bring rates down to 3.75%. Some banks, including ING and Deutsche Bank, are even forecasting a third cut, pushing rates as low as 3.5% by Christmas.

But the BoE is cautious. It doesn’t want to cut too quickly and risk inflation rebounding. Global factors — like oil prices or renewed trade disruptions — could drive prices up again, forcing the Bank to change course. So while the direction of travel seems set, the pace is still very much up for debate.

What Does This Mean for the UK Housing Market?

The UK housing market has been surprisingly resilient in 2025. Average house prices in June stood at £268,400, up around 1.3% on the year. That’s modest growth, but it’s growth nonetheless — especially given the cost of borrowing is still relatively high by recent standards.

More notably, buyer demand is up 11%, agreed sales have risen 8%, and there’s a record number of homes for sale. Lenders are easing their mortgage affordability tests, making it easier for people to borrow, even without a rate cut.

However, the market is very regional. Areas in southern England are seeing slower growth (or even slight declines) due to oversupply and affordability challenges. Meanwhile, Scotland, Wales, and the North of England are showing stronger price momentum.

Spotlight on Scotland: Still Going Strong

In Scotland, the property market has outperformed much of the UK. Average prices have jumped nearly 6% year-on-year, rising from £181,273 in June 2024 to £191,927 in May 2025 — a gain of over £10,000.

East Lothian has seen the biggest jump (around £27,946), while other areas like Aberdeenshire and South Ayrshire have dipped slightly. As always, the Scottish market is patchy — some areas are booming, others are stagnating. But overall, the trend is upward.

If the Bank of England does begin cutting rates in August, Scotland could benefit more than most. Strong demand and relatively affordable prices — especially compared to London or the South East — mean any improvement in affordability from falling mortgage rates is likely to translate into continued activity.

Will Interest Rate Cuts Boost the Market?

If the Bank Rate is cut from 4.25% to 4.00% (or lower), borrowing becomes cheaper. That means lower monthly payments for new buyers and for homeowners coming off fixed-rate deals. Already, we’re seeing a rise in remortgaging: June saw the highest volume of refinances since the mini-budget fallout in 2022.

The question is how much this improved affordability will actually push up house prices. Most analysts think growth will remain modest — around 1–1.5% across the UK this year — but rate cuts could certainly stabilise markets and give them a little lift.

In Scotland, where the market has more momentum and less saturation, the impact might be slightly stronger. Areas with strong local economies and tight supply — such as Edinburgh, Glasgow, and parts of the central belt — could see continued upward pressure on prices.

Risks on the Horizon

There are still plenty of uncertainties that could throw a spanner in the works.

If inflation proves more persistent than expected — especially in services or wages — the Bank of England may delay or even pause its easing cycle. That would keep mortgage rates higher for longer and could cool demand again.

On the other hand, if economic growth slows more dramatically — or if unemployment rises faster than forecast — the BoE could cut more aggressively. That might push rates down to 3.5% or even 3.25%, potentially fuelling a more noticeable housing rebound.

Fiscal policy is another wildcard. If the government tightens spending or raises taxes to address debt concerns, that could dampen consumer sentiment and slow the housing market, especially in areas already under strain.

What Should Buyers and Sellers Do?

If you’re thinking of buying or selling in the next 6–12 months, here’s the takeaway:

• Don’t expect a price boom. Most of the UK is likely to see only modest price growth for the rest of 2025.

• Do expect some mortgage relief. Rate cuts — if they come — will improve affordability, albeit gradually.

• Scotland remains relatively strong. If you’re buying in a high-demand area, you may face competition, even with rates still relatively high.

• Consider timing. If you’re remortgaging, the second half of 2025 could offer better deals. If you’re buying, consider locking in now if a deal suits you — waiting may not offer significant savings unless rates fall faster than expected.

In conclusion...

The UK housing market is walking a tightrope in 2025 — caught between stubborn inflation and a sluggish economy. The Bank of England is expected to start easing interest rates, but it’s doing so cautiously, mindful of risks both at home and abroad.

For property, the outlook is stable rather than spectacular. In Scotland, especially, demand remains solid and prices are climbing at a healthier clip. But don’t expect fireworks. The real shift will come if rates fall faster than expected — or if inflation finally returns to target.

Until then, it’s a case of steady as she goes.

- Details

- Hits: 372

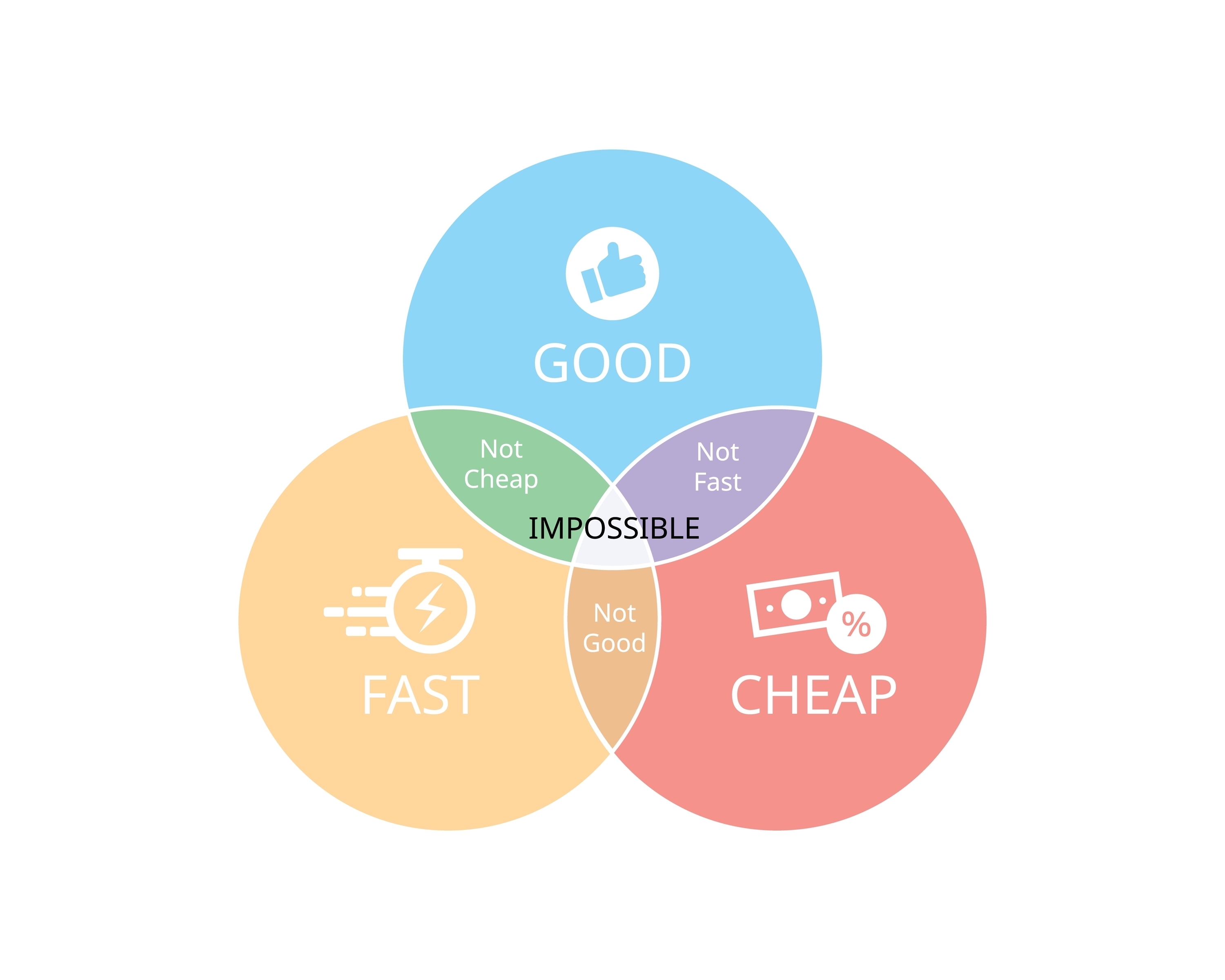

Fast, Cheap, or Good: The Balancing Act in Estate Agency

In the competitive world of Scottish estate agency and property management, the age-old saying still rings true: "You can have it fast, cheap, or good — but not all three." This principle, often referred to as the Project Management Triangle, speaks directly to the trade-offs businesses must manage — and nowhere is this more important than in the property sector, where trust, value, and care are everything.

Scotland’s property market, particularly in cities like Edinburgh, Glasgow, and Inverness, is both dynamic and demanding. For estate agents and property managers, the challenge is not just to close deals or turn over tenancies quickly, but to build long-term relationships with landlords, homeowners, tenants, and guests — all while maintaining the highest standards of service.

Let’s take a look at the permutations of the triangle….

Fast and Cheap might suit the short-term investor, but it rarely satisfies property owners with high-value assets. Rushed tenant placements, cut-rate maintenance, and impersonal communication can lead to void periods, property damage, and ultimately, lost trust.

Fast and Good requires investment — in people, technology, and proactive service. It means having the right systems and staff in place to respond promptly to viewings, maintenance issues, and legal compliance. It’s effective, but not bargain-basement pricing.

Cheap and Good can be possible, but only if landlords are patient. Finding the right tenant, organising quality repairs at a fair price, or navigating complex licensing (especially for short-term lets) takes time and attention. Rushing these steps risks undermining the very quality you’re aiming for.

People First: Property Is Personal

At the heart of all this lies a simple truth: property is deeply personal. For landlords, their property is often their biggest investment, sometimes even their family home. It deserves personal, attentive management — not a one-size-fits-all approach.

For buyers and tenants, it’s more than a transaction; it’s their future home. Treating them with respect, honesty, and professionalism builds trust and secures longer-term tenancies and positive word-of-mouth.

For home sellers, the stakes are equally high. Whether moving up the ladder or releasing equity, sellers want the best price, minimal hassle, and expert guidance — but these outcomes don't come from rushed listings or budget marketing packages. A good agent invests time in staging advice, high-quality photography, and pricing strategy, ensuring that the property stands out in a competitive market. That takes commitment and real empathy with the owners needs, not shortcuts.

In short-term lets, where Scottish legislation is tightening and competition is fierce, guests should be welcomed as VIPs. Every touchpoint — from check-in to cleaning — should reflect quality and care. That level of hospitality doesn’t come from the cheapest provider or the fastest turnaround; it comes from prioritising excellence.

A Commitment to Quality

Balancing speed, cost, and quality is never easy, but at Logan Property, the focus remains clear: do it right, or not at all. In an industry where reputation is everything and assets are high-stakes, cutting corners isn’t worth the risk. We choose to invest heavily in technology and our people. The platforms we use represent the gold standard in their respective fields are our team are diverse, smart and the best at what they do.

Whether you’re a landlord, tenant, buyer, or guest, you deserve a service that treats your investment, your home, or your experience with the attention it warrants. That’s not always the fastest or cheapest route — but it’s the one that delivers lasting value.

- Details

- Hits: 932

Edinburgh City Council has just announced a pivotal update that will affect all stakeholders in the city’s short-term rental market—particularly property investors. Effective immediately, the duration of short-term let (STL) license renewals has been extended from one year to three years. For investors and operators, this change introduces a much-needed dose of regulatory stability and operational predictability.

Regulatory Maturity Brings Confidence

This policy shift marks a key milestone in the evolution of Edinburgh’s short-term let regulatory framework, which has been in place since October 2022. Initially met with resistance from many operators and investors due to its perceived rigidity and bureaucracy, the system is now showing signs of flexibility and maturity. The council’s decision to move to a triennial renewal cycle signals its willingness to respond to market feedback and reduce administrative friction—an encouraging sign for long-term investors.

The extended licensing period allows investors to better project cash flows, manage compliance budgets, and plan renovation or reinvestment timelines without the looming uncertainty of annual renewals.

Reduced Overhead, Higher ROI Potential

Annual license renewals imposed recurring administrative burdens and potential operational interruptions. For professional investors managing multiple units or building portfolios around Edinburgh’s high-performing STL market, these frictions added complexity and risk.

By moving to a three-year renewal window, the council is effectively lowering the regulatory overhead. This shift will help increase net operating income (NOI) by reducing time and costs associated with repeated paperwork and potential business disruptions—translating to improved return on investment (ROI).

A Balanced Policy for Sustainable Growth

This change comes as the council attempts to balance the twin priorities of protecting housing stock and supporting Edinburgh’s vital tourism economy. While short-term lets have been under scrutiny for their impact on residential availability, this policy tweak does not loosen enforcement—it simply makes the licensing system more efficient.

Investors can take reassurance from the fact that this is not a rollback of regulation but an optimization of the framework. Compliance requirements remain in place, but the process will now align more closely with the investment cycles of property owners and operators.

Strategic Implications for the STL Market

For those considering entry into the Edinburgh STL market, this announcement significantly de-risks the licensing environment. With a clearer regulatory horizon, the investment case for acquiring or converting property for short-term rental becomes more compelling.

Moreover, for current owners, the extended renewal period may increase the resale value of licensed properties, as prospective buyers are now inheriting a more stable regulatory position. In a market where licensing is mandatory, this can be a key differentiator.

Final Thoughts: A Vote of Confidence in the Market

Edinburgh’s decision to extend STL license renewals from one to three years is more than just a bureaucratic tweak—it’s a vote of confidence in the city’s short-term rental sector and the investors behind it. For those looking to build or expand portfolios in high-demand urban markets, Edinburgh just became a more attractive and predictable place to invest.

- Details

- Hits: 3621

As Edinburgh adapts to a new era of regulated short-term letting, the city’s licensing scheme presents a unique opportunity for agile property operators. At the intersection of compliance and innovation stands Logan Property—ready to leverage policy flexibility for maximum client benefit.

Understanding the Current Landscape

Edinburgh City Council has implemented a mandatory short-term let (STL) licensing system effective from October 2022, requiring all hosts to obtain a licence before letting. This applies to all STL categories: secondary letting, home letting, home sharing, or a hybrid of these models.

The primary goals of the scheme are to improve safety standards, reduce disruption in communities, and control the proliferation of short-term rentals in key areas.

Flexible Options: Temporary Licences and Exemptions

To accommodate seasonal demand and part-time hosts, the council introduced two important mechanisms:

Temporary Licence – Up to 6 Weeks

Ideal for hosts testing the STL model or capitalizing on high demand events, a temporary licence permits short-term letting for up to six weeks.

Key features:

- Streamlined process with reduced documentation compared to full licences.

- No requirement for EICR or PAT certificates (as of January 31, 2025), although obtaining them is encouraged.

- Useful for festival periods, trial rentals, or adhoc guest bookings.

Temporary Exemption – Up to 6 Weeks in a 12 Month Period

This exemption permits letting without a full licence during specified times, such as:

- Edinburgh Festival Fringe

- Hogmanay celebrations

- Major sporting events

Multiple exemptions can be used in a year, provided the total doesn’t exceed six weeks.

Special Advantage for HMO Licence Holders

Here’s where the policy really opens doors: HMO (House in Multiple Occupation) licence holders can apply for a temporary short-term let licence at a significantly reduced fee—just £120.

This represents:

- A substantial saving compared to standard STL fees (typically £250+).

- An efficient transition path between long-term and short-term use.

- Simplified compliance, as HMO properties already meet many safety and occupancy standards.

But is it worth it? When we review our short-term let portfolio performance over the course of the year, 40% of reservation revenue is achieved during the months of June, July and August. So yes, it is worth it!

Logan Property: Built for Adaptive Strategy

Logan Property is uniquely positioned to help property owners take full advantage of Edinburgh’s STL policies. Here’s why:

- Dynamic Use Planning

We specialize in properties that flex between long-term occupancy and short-term letting—especially for student lets, professional co-living, and festival season visitors.

- Compliance Expertise

Our team stays up to date with evolving local regulations and ensures seamless navigation of licensing, exemptions, and safety requirements.

- Optimized Revenue Models

By transitioning properties during peak tourism periods—such as the Edinburgh Festival Fringe—we help clients maximize occupancy and income while maintaining full regulatory compliance.

- HMO Integration

Given our portfolio includes numerous HMO licensed properties, we’re ideally positioned to quickly pivot into temporary STL opportunities using the £120 licensing route. This adaptability offers our clients a low risk, high reward strategy.

Conclusion

Edinburgh’s short-term let licensing regime may seem complex, but within it lies opportunity—especially for those with the flexibility and knowledge to adapt.

Logan Property offers a smart, compliant, and agile approach to property management that aligns with both city policy and market demand. With options like temporary licences, exemptions, and cost effective routes for HMO licence holders, we help our clients make the most of every letting window.

Whether you're a seasoned landlord or a curious host exploring new avenues, the time to be flexible is now—and Logan Property is your perfect partner.

- Details

- Hits: 917

The first recorded competitive high jump was held in Innerleithen, Scotland, in 1827. Back then, the ‘scissors’ approach was used by athletes to clear the bar and the world record was set at 1.575m (5’2). This approach was adapted and modified by athletes over time, from the ‘Eastern cut-off’ (1.97m), the ‘Western Roll’ (2.01m) and the ‘Straddle’ (2.13m).

Then in 1973, with the adoption of raised, softer, cushioned landings, Dick Fosbury introduced the world to the ‘Fosbury Flop’, clearing the bar and landing on his back. This new innovation was quickly adopted by athletes throughout the world, with US athlete Dwight Stones setting a new world record in 1973 at 2.3m. Suddenly the marginal gains achieved in the past seemed anaemic. The Fosbury Flop remains the style used by athletes to this day, with the world record now at 2.45m (a smidge over 8’)!

But the high jump itself has not changed. It has remained a competition in which athletes attempt to jump, leap or otherwise clear a horizontal bar. But the method to do so has evolved, through the relentless pursuit of excellence by athletes, seeking every ounce of competitive advantage they can.

Unlike the high jump, the world of real estate in Scotland has gone through more than its fair share of change and upheaval. Regulatory compliance, legislative changes and evolving consumer demands are just a few of the challenges we all face on a daily basis. Coupled with declining supply of rental property stock and rising costs impacting property sales, we frequently find ourselves in a position of needing to do more, with less.

When I first started in this business, I had little more than a spreadsheet, a little optimism and a lot of hope. And it was enough. Until it wasn’t. Manual systems have their limitations and before long, human error creeps in and oversight places increasing demands on time. In a business that is built on personal relationships, it is counter-productive to be sweating in front of a screen, making sure everything that needs to happen, has happened.

Automating processes as much as possible allows us to scale and grow, and affords us the time to concentrate on what is truly important. From those early, ‘stress-and-spreadsheets’ days, we have adopted many platforms that provide high levels of automation for mundane tasks. Without endorsing any of them, a few of our favourites include PayProp, providing an automated and fully auditable platform for rent payments and transactions. Our short term let portfolio would not be able to function without our property management system, providing guest communication, pricing, calendar integration, amongst many other functions. And our anti-money laundering platform provides rapid background checks and identity verification, when working on residential sales.

All of these systems are transactional in nature. They perform set tasks well, but they lack ‘intelligence’. What does the brave new world of AI have to offer our industry? Common consensus says that any knowledge-based industry will be radically transformed. The introduction of AI commoditises knowledge, makes it available to everyone. And consequently, devalues it. Whilst real estate is not strictly a ‘knowledge economy’ market, it has many aspects that fit the definition. Applying AI to valuation and investment analytics helps informs buyers and sellers alike, as well as predicting emerging market trends and investment opportunities. Many of our legal and compliance requirements can be streamlined and enhanced with the use of AI and customer satisfaction can be improved with the use of tools to respond to routine enquiries, scheduling viewings and recommendations.

AI will undoubtedly commoditise knowledge. It will also be a great leveller, creating an even playing field where small, independent agencies can compete with the larger, multi-branch agencies. It feels oxymoronic – but the adoption of AI driven systems will allow us as real estate professionals to focus on what is truly important in this industry – the personal relationships with landlords, tenants, sellers and buyers. Ours is a people industry. The bar keeps getting set higher and we have the tools to innovate and clear it in our hands.